Sometimes old problems appeared in new guises. Attention came to rest once more on self-regulatory organizations, particularly after an academic study suggested that Nasdaq market makers were colluding in fixing prices. This led to an investigation that produced a consent agreement with NASD, a $25 million payment, and commitment to new procedures and a revitalized internal enforcement function.(1) In connection with this the Commission also reached a $27 million settlement with 28 market makers.(2)

The Internet also created new opportunities for fraud. Penny stock fraud had been a recurrent problem since the 1930s, and had surged toward the end of the 1980s, but had been briefly tamped down by new Rule 15c2-6 and provisions of the Remedies Act which together placed new requirement on brokers selling penny stocks and implemented the over-the-counter bulletin board to create greater price transparency.(3) It grew again in the late 1990s, though, fueled by the rise of the internet and the internet stock bubble, which produced both new enthusiasm for shares of unknown firms and new tools to hype and then sell (pump and dump) them.(4) Linda Chatman Thomsen, later Director of Enforcement, recalled that Internet cases “were all the rage because it was a new way to do schemes and pass information.”(5) In response the Division formed an Office of Internet Enforcement and identified internet fraud as a “program area,” running a series of highly publicized “sweeps” during the late 1990s and charging dozens with fraud.(6) As one journalist astutely noted, the sweeps were just the latest instance of the Division “marshaling limited resources and garnering maximum publicity for the agency’s enforcement efforts.”(7)

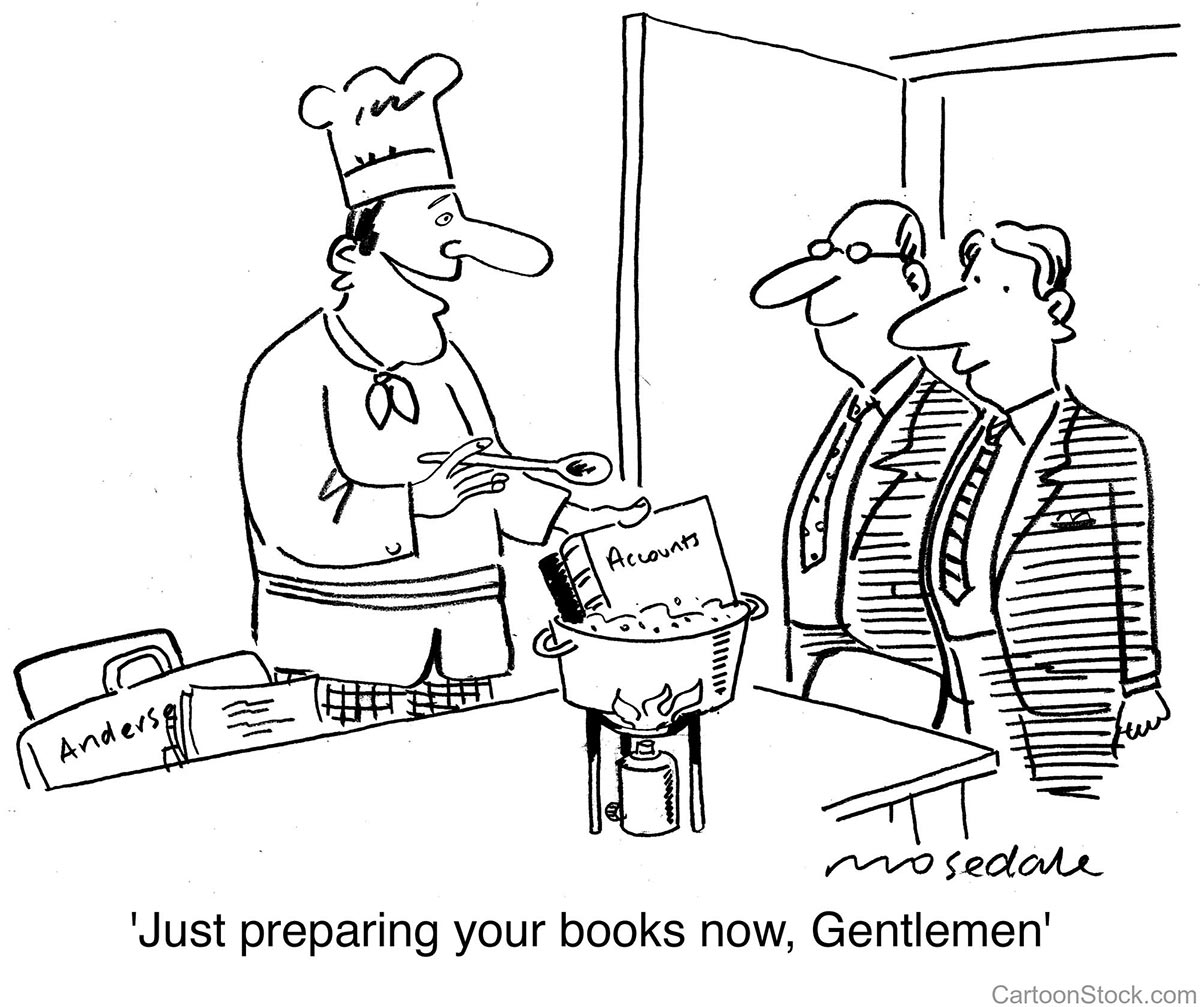

Accounting fraud rose to the top of the enforcement agenda in the late 1990s, propelled by business developments and Arthur Levitt’s fierce opposition. “Earnings management” was rampant; in 1997 alone 116 companies corrected or restated their financial statements.(8) In early 1998, Levitt gave his soon-famous speech “The Numbers Game,” warning that in corporate accounting “management may be giving way to manipulation.”(9) Again concentrating its efforts, the Division formed a “Financial Fraud Task Force” focused exclusively on financial reporting and accounting investigations, which paired lawyers and accountants and provided them time and resources to investigate the cases in depth, speeding what had become in many cases a drawn-out enforcement process.(10) Over the next few years the SEC would charge prominent firms including W. R. Grace, Waste Management, Cendant, Livent, HBOC McKesson, Microstrategy, and Xerox with misstating or manufacturing earnings. The amounts at issue could be staggering; in 1998, for instance, Waste Management restated its earnings for the previous six years, and eventually turned out to have overstated earnings by $1.4 billion. The case earning the most publicity may have been that against Sunbeam, whose CEO “Chainsaw” Al Dunlop had sold himself as a corporate turnaround artist but was revealed as a simple fraud.(11)

(1) Seligman 698-701.

(2) Seligman: 701

(3) William McLucas, Stephen M. DeTore, and Arian Colachis, SEC Enforcement: A Look at the Current Program and Some Thoughts About the 1990s, 46 Bus. Law,. 797, 814-817 (1990).

(4) Linda Thomsen oral history: 13; Andrew Fraser, Who’s Watching: It’s a wild world out there in cyberspace, and the investment police can’t keep up with it, Wall St. J. June 14, 1999: R17.

(5) Thomsen oral history: 13.

(6) Michael Schroeder, SEC Charges 13 Illegally Touted Stocks Online, Wall St. J. February 26, 1999: A16.

(7) Andrew Fraser, Who’s Watching? It’s a wild world out there in cyberspace, and the investment police can’t keep up with it, Wall St. J. June 14, 1999: R17.

(8) Partnoy, Infectious Greed: 211.

(9) Arthur Levitt, The “Numbers Game,” Sept. 28, 1998.

(10) Paul Berger oral history; Paul Berger Speech to AICPA December 5, 2000, SEC website.

(11) Michael Schroeder, Dunlap Settles SEC Fraud Charges, Agrees to Ban and $500,000 Penalty, Wall St. J. Sept 5, 2002.

Paul R. Berger was on the staff of the Securities and Exchange Commission for 14 years, from 1992 to 2006. He joined the Commission as a staff attorney in the Division of Enforcement and eventually become Associate Director in 2000. He helped establish and chaired the Commission’s Financial Fraud Task Force and played a leading role in the Commission’s focus on the Foreign Corrupt Practices Act. He was responsible for numerous cases in the areas of financial fraud, foreign payments (bribes), executive compensation, auditor independence, Regulation FD, broker-dealer matters and insider trading.

Christopher R. Conte spent 17 years in the Division of Enforcement of the SEC where he became Associate Director. During his tenure he conducted and oversaw significant enforcement matters across all of the SEC's major program areas including actions involving financial fraud, improper accounting and internal controls and disclosure violations, audit failures, unlawful market timing arrangements, illicit payments under the FCPA, manipulative short selling, unlawful IPO allocation practices, and insider trading.