As the decade closed, the Enforcement Division was still energetically pursuing fraud and malfeasance. At the same time, it again struggled with lack of resources and support. After increased allocations in the late 1980s, the anti-regulatory mood of the 1990s, particularly after the election of 1994, meant a return to flat budgets. According to a Government Accounting Office report, in the 1990s “the number of complaints and inquiries received increased by 100 percent, while the enforcement staff . . . increased by 16 percent.”(1) Demand for securities lawyers also grew in the private sector, whose skyrocketing salaries were not matched by the government, producing increasing turnover at the Commission.(2)

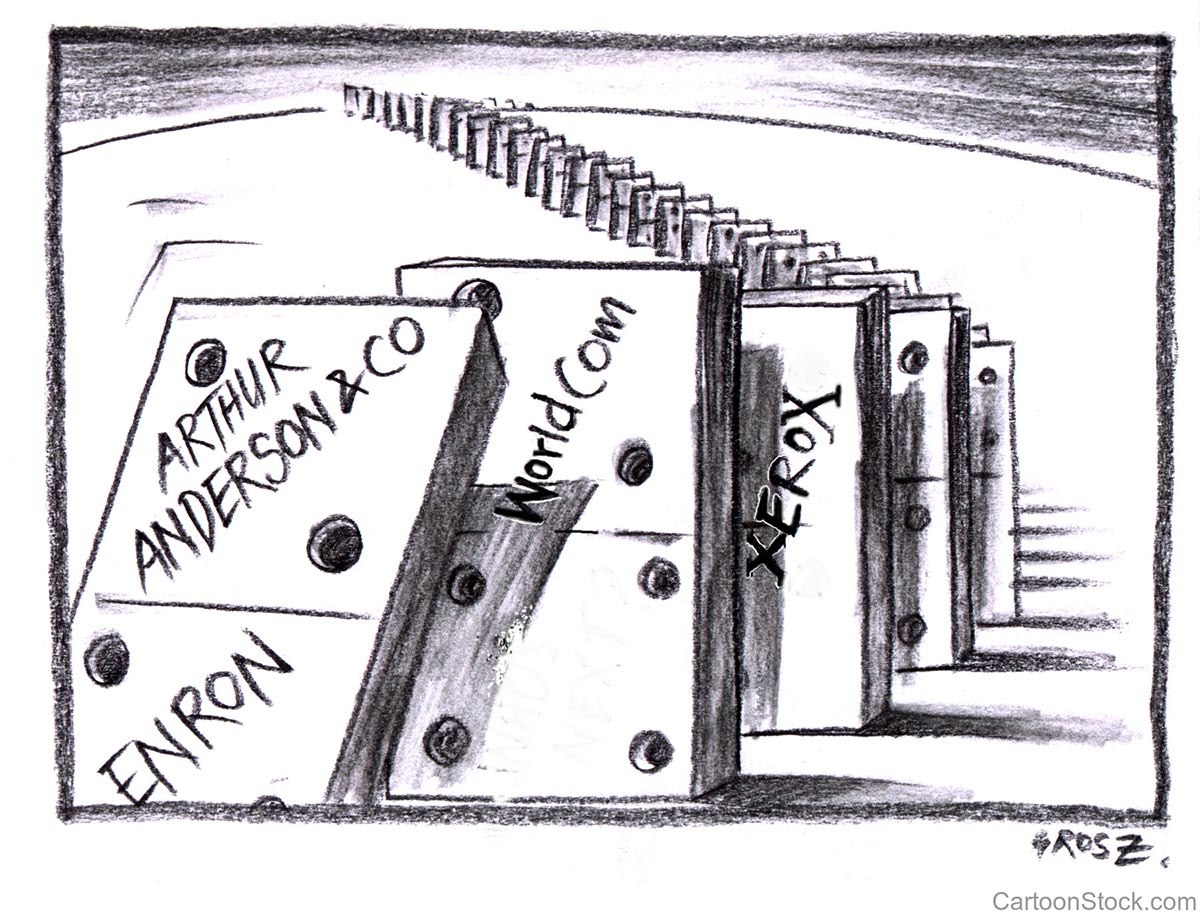

2001 was an unexpected watershed. For much of the nation, the 9/11 attacks defined the year, and the SEC was not untouched; its New York offices at 7 World Trade Center were destroyed in the attacks, though with no loss of life to the staff. What changed the Division’s work was, however, the collapse of Enron. At the beginning of the year it was by some measures the nation’s fifth-largest company, routinely praised for its corporate governance; at the end it was in bankruptcy, brought down by shady accounting and outright fraud. The next year similar scandals would rock giant firms including Global Crossing, WorldCom, Adelphia, Tyco, and Qwest. The details would differ, but in each dubious or simply fraudulent accounting doomed the firms. Levitt’s warning about the “numbers game” had been proven correct.

The immediate aftermath was investigations, staggering fines, and in some cases imprisonment. The amount of penalties paid by companies caught in accounting fraud would be unprecedented. In 2002, as a result of work by the Financial Fraud Task Force, Xerox had been fined $10 million, at that point the largest fine ever levied against a public company in an accounting matter.(3) Between 1990 and 2002, only four other issuers had been fined, for a total of less than $5 million.(4) Those numbers would soon appear paltry. From 2003 to 2007, the total amount of penalties and disgorgement resulting from enforcement cases was $13.8 billion, the largest single penalty being against WorldCom for $750 million.(5) Large fines were also levied against gatekeepers alleged to have enabled or overlooked the frauds. In 2003, for instance, the investment banks J. P. Morgan Chase and Citigroup settled with the SEC for their roles in various Enron schemes, paying disgorgement and penalties totaling $255 million.(6)

In the wake of these scandals, the SEC drew both criticism for not catching the frauds earlier, and new powers. The new powers, contained in the Sarbanes-Oxley Act of 2002, had greater effect. The Act increased the budget for the agency, allowing it boost the Enforcement staff by 30% by 2004, and to pay them more; included a requirement that CEOs and CFOs certify a firm’s financial reports; created the Public Company Accounting Oversight Board (“PCAOB”), to oversee public company audits; and, in a less-noticed change, included a provision allowing the SEC to direct penalties to investors harmed by fraud (“Fair Funds”).(7) Together, aggressive enforcement efforts and SOX’s new measures had real effect; accounting misstatements and fraud seemed to have been permanently reduced.(8)

Fair Funds’s impact was particularly striking. Debate had long simmered over whether it was appropriate to impose large penalties on corporations, as these would ultimately be paid by shareholders unaware of, and victimized by, their companies’ wrongdoing. Fear of harming these “innocent” shareholders had served as a brake on giant penalties. Fair Funds took that away by creating a mechanism to channel penalties to injured parties, including shareholders. While not the sole reason for the sharp rise in giant penalties after 2002, Fair Finds made such penalties much easier to justify. One former Director of Enforcement described the post-Enron penalty powers being “wielded with numbers and a ferocity that I don’t think anyone had anticipated.”(9) The giant penalties also reignited a debate over the purposes of enforcement remedies: were they chiefly regulatory, to encourage future compliance, or punitive, to punish past wrongdoing?

(1) Seligman: 637.

(2) Stephen Labaton, SEC is Suffering from Nonbenign Neglect, N. Y. Times July 20, 2002: C1.

(3) Kathleen Day, Xerox Admits Nothing but Will Pay $10 Million Fine, Wash. Post. April 12, 2002: E2.

(4) Atkins & Bondi, Evaluating the Mission: 394.

(5) SEC Annual Report 2007: 26.

(6) SEC Settles Enforcement Proceedings Against JP Morgan Chase and Citigroup, SEC Press Release 2003-87 (July 28, 2003), SEC website.

(7) Sarbanes-Oxley Act of 2002.