The concept of “materiality” is the cornerstone of the Securities and Exchange Commission’s public company disclosure regime. It is a fundamental principle of the Securities Act of 1933 and Securities Exchange Act of 1934.

In celebration of a new gallery on the history of the US Securities and Exchange Commission’s Regional Offices, the SEC Historical Society hosted a special program on the evolution of the San Francisco Regional Office.

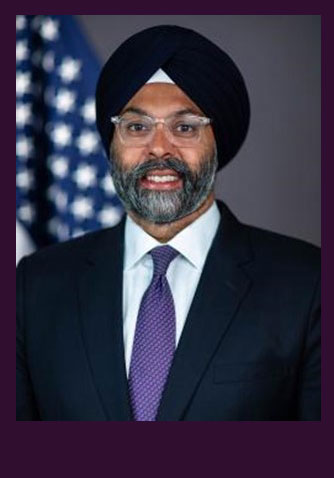

The Securities and Exchange Commission Historical Society, Baker McKenzie, and the South Asian Bar Association of Washington, DC (SABA-DC) presented a fireside chat with Gurbir S. Grewal, Director of the Division of Enforcement of the U.S. Securities and Exchange Commission. The May 17 event was held in person in Washington, DC and broadcast from this website.

The SEC Historical Society is pleased to share its 2022 annual report. This report contains the highlights of Virtual Museum-related projects, the audited financial statements, and the lists of donors and contributors for the year 2022.

Thank you very much to those who support the mission of the Society to grow and make available the unique collection in our Virtual Museum.